Nepal Rastra Bank, Economic Research Department, Baluwatar, Kathmandu published Current Macroeconomic and Financial Situation of Nepal Based on Four Months Data Ending Mid-November, 2024/25.

Nepal Rastra Bank (NRB) recently published the current macroeconomic and financial situation in Nepal. Some major highlights of the Nepal Economy are provided. Banking Exam Preparation Special.

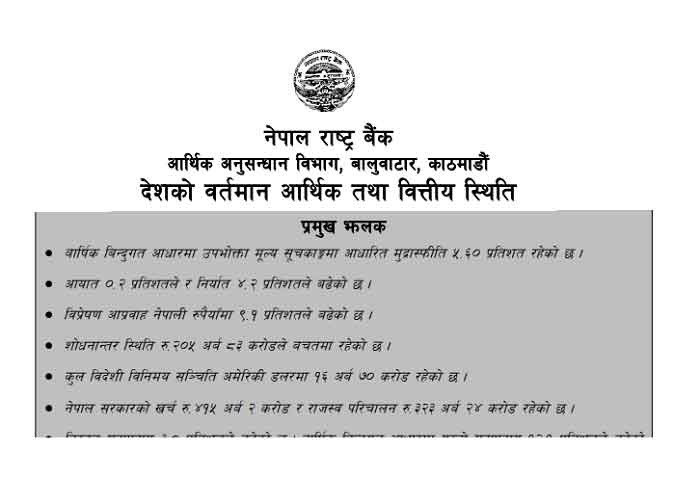

Major Highlights

CPI-based inflation remained 5.60 percent on y-o-y basis.

Imports and exports increased 0.2 percent and 4.2 percent respectively.

Remittances increased 9.1 percent in NPR terms.

Balance of Payments remained at a surplus of Rs.205.83 billion.

Gross foreign exchange reserves stood at 16.70 billion in USD terms.

Nepal Government expenditure amounted to Rs.415.02 billion and revenue collection Rs.323.24 billion.

Broad money (M2) increased 3.0 percent. On y-o-y basis, M2 expanded 12.1 percent.

Deposits at BFIs increased 2.3 percent and private sector credit increased 2.5 percent. On y-o-y basis, deposits increased 12.6 percent and private sector credit increased 6.2 percent.

Inflation

Consumer Price Inflation (CPI)

- The y-o-y consumer price inflation stood at 5.60 percent in mid-November 2024 compared to 5.38 percent a year ago. Food and beverage inflation stood at 9.10 percent whereas non-food and service inflation stood at 3.65 percent in the review month. During the same period in the previous year, the price indices of these groups had increased 5.98 percent and 4.99 percent respectively.

- Under the food and beverage category, y-o-y price index of vegetable sub-category increased 33.99 percent, pulses and legumes 10.78 percent, cereal grains & their products 10.15 percent and ghee & oil 9.29 percent. However, the y-o-y price index of spices sub-category decreased 1.41 percent, sugar & sugar products 1.28 percent and meat & fish 0.02 percent.

- Under the non-food and services category, y-o-y price index of miscellaneous goods and services sub-category increased 10.41 percent, alcoholic drinks 6.35 percent, clothes and footwear 4.57 percent and tobacco products 4.24 percent.

Remittances

- Remittance inflows increased 9.1 percent to Rs.521.63 billion in the review period compared to an increase of 22.5 percent in the same period of the previous year. In the US Dollar terms, remittance inflows reached 3.87 billion in the review period which was 3.60 billion in the same period of the previous year.

- Net secondary income (net transfer) reached Rs.568.26 billion in the review period compared to Rs.521.43 billion in the same period of the previous year.

- The number of Nepali workers, both institutional and individual, taking first-time approval forforeign employment stands at 147,478 and taking approval for renew entry stands at 94,105. In the previous year, such numbers were 137,475 and 68,841 respectively.

Current Account and Balance of Payments

- The current account remained at a surplus of Rs.143.42 billion in the review period compared to a surplus of Rs.97.10 billion in the same period of the previous year. In the US Dollar terms, the current account registered a surplus of 1.06 billion in the review period against a surplus of 730.58 million in the same period last year.

- In the review period, net capital transfer amounted to Rs.2.47 billion. In the same period of the previous year, such transfer amounted to Rs.1.59 billion. Similarly, in the review period, Rs.5.76 billion foreign direct (Equity only) investment was received. In the same period of the previous year, such foreign direct (Equity only) investment inflows amounted to Rs.3.65 billion.

- Balance of Payments (BOP) remained at a surplus of Rs. 205.83 billion in the review period compared to a surplus of Rs. 150.24 billion in the same period of the previous year. In the US Dollar terms, the BOP remained at a surplus of 1.53 billion in the review period compared to a surplus of 1.13 billion in the same period of the previous year.

Liquidity Management

- In the review period, NRB absorbed, on a transaction basis, a total liquidity of Rs.10775.95 billion, including Rs.807.30 billion through deposit collection auction and Rs.9968.65 billion through the Standing Deposit Facility (SDF).

- In the review period, NRB injected liquidity of Rs.257.15 billion through the net purchase of USD 1.92 billion from the foreign exchange market. Liquidity of Rs.232.77 billion was injected through the net purchase of USD 1.75 billion in the corresponding period of the previous year.

- The NRB purchased Indian currency (INR) equivalent to Rs.161.48 billion through the sale of USD 1.20 billion in the review period. INR equivalent to Rs.135.51 billion was purchased through the sale of USD 1.02 billion in the corresponding period of the previous year.

=> Current Macroeconomic and Financial Situation-Tables (Based on Four Months Data of 2024/25) New

=> Current Macroeconomic and Financial Situation – English (Based on Four Months Data of 2024/25) New

=> Current Macroeconomic and Financial Situation-Nepali (Based on Four Months Data of 2081/82) New

Also view:

1. View All Job Vacancy Notice Details

2. View All TU Exam Result Center Update

3. View All Lok Sewa Exam Vacancy Tayari